A KRA PIN is an essential document required in various instances, from opening a bank account to securing a job or conducting business in Kenya. It serves as your unique identifier with the Kenya Revenue Authority (KRA) for taxation purposes.

The good news? Applying for a KRA PIN is fast and straightforward. With the right guidance, you can complete the process online in under five minutes and receive your PIN certificate instantly.

Follow this blog for step-by-step instructions to make the process even easier!

There are two taxpayer types: individuals and non-individuals. Non-individuals include entities such as companies, schools, NGOs, and diplomatic organizations, among others. In this guide, we will focus on how to apply for an individual PIN.

Step by Step Guide on how to apply for the KRA Pin

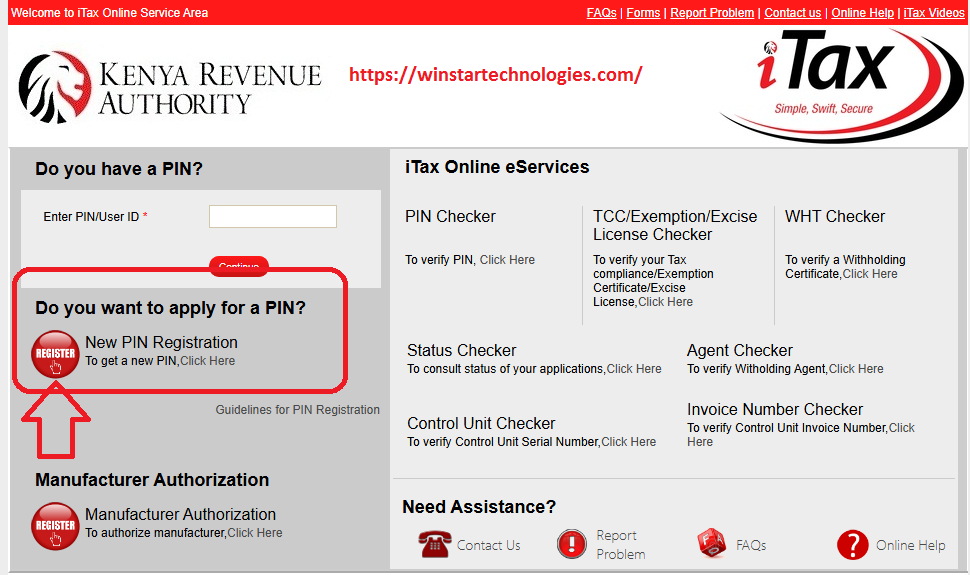

Go to the itax portal https://itax.kra.go.ke/KRA-Portal/

On the left-hand side, where it says “Do you want to apply for a KRA PIN?”, click the “Register” button.

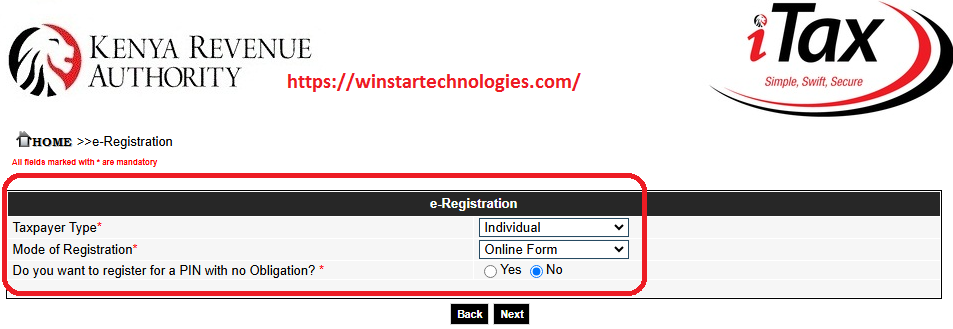

On the next page, select “Individual” as the taxpayer type and choose “Online Form” as the mode of registration. Confirm whether you want to create a PIN without a tax obligation. If you select “Yes,” you must add an obligation later. Click “Next” to proceed. An e-registration form for individuals will open.

Register for KRA Pin

There are three basic tabs that you must fill.

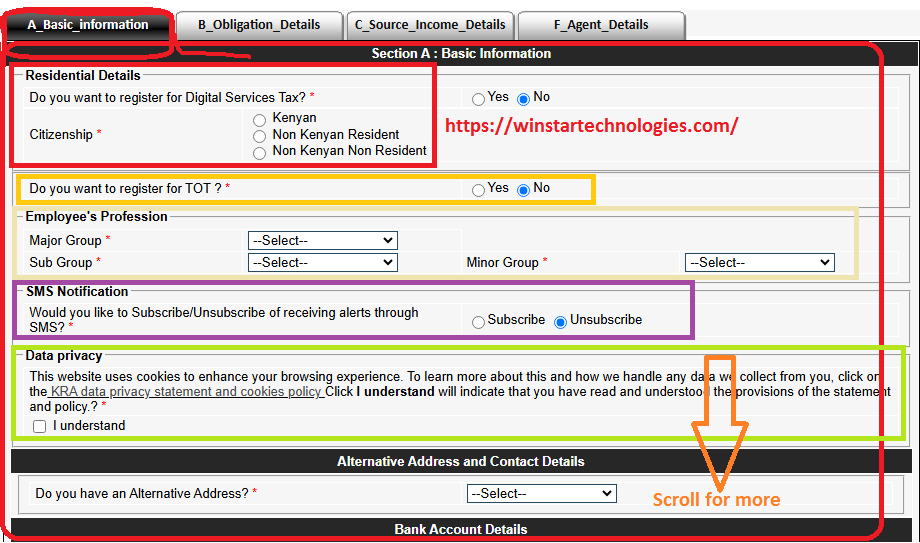

Basic Information Tab

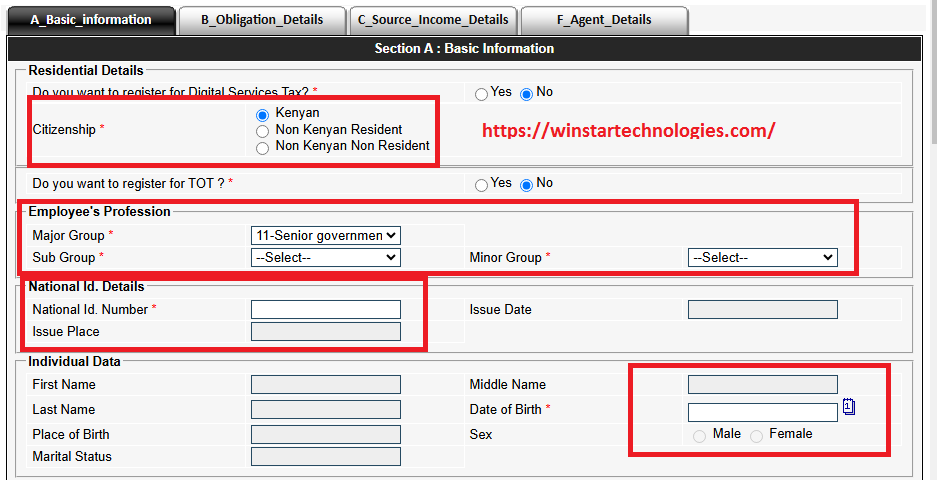

Select your registration status. The options available are; Kenyan, Non Kenyan Resident or Non-Kenyan Non-Resident. To register as a Non-Kenyan Resident you will require an Alien ID and for Non-Kenyan Non-Resident you need a passport. For Kenyan citizens your national ID is required.

Select the appropriate residential details and below indicate if you want to register for TOT. However not that TOT obligation is for business people.

Select your profession. Choose the major group and leave the rest if not opening.

On the national ID details area, enter your ID number. On the individual data section enter your date of birth as it appears on the ID. If on the ID the date has no month and date, then use 01/07 then the year indicated on the document.

After entering the date, the system will auto-populate some of your personal data and parent details if the ID number and date of birth are correct. If you get an error message that ‘A PIN has been issued for entered National Identity Number xxxxxxxxx. Kindly enter a different National Identity Number or consult the nearest KRA office for clarification’, this means you already have a pin. In such a case you should go to any KRA station or Huduma center with your original ID. They will retrieve your pin.

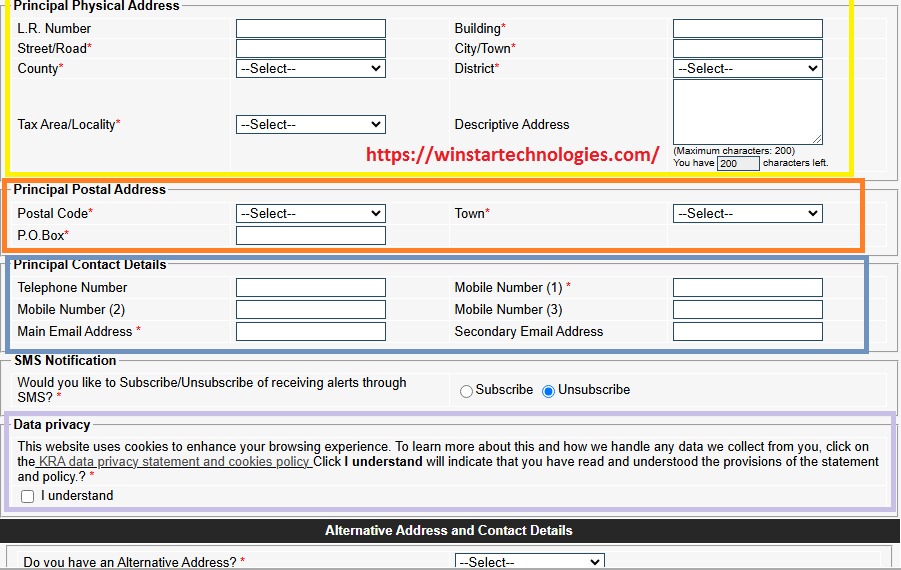

For the Principal Physical Address, indicate where you stay by entering the street or road, County, Building, City or Town, District, and your Tax area. Note that the physical address you select should be an area you can access easily. This is because it will be your tax station where you will go whenever you have issues relating to your pin or taxes.

Enter your principal postal address and postal code.

Contact Details

The next stage is to enter contact details. Enter your mobile number and email address. Make sure you can be able to access the email address you provide. After entering your email address, it will be checked if it has been used by another taxpayer. You will get a pop-up message ‘To continue using iTax functionality you are required to verify your email address. Please click the “Send OTP” button to receive OTP on the mentioned email address.’ Click on the new button that appears to send an OTP code to your registered email.

Open your email and check for an email from admin.itax2. Look for a four-digit code, note it down and go back to the iTax portal. Enter it where it is written OTP code. Note that the code should be used within the first 15 minutes as it expires after that.

The other information that follows is optional. That is SMS notifications, alternative addresses, bank account details, if you are a director elsewhere and tributary bonds. At this stage, you are ready to go to the next tab.

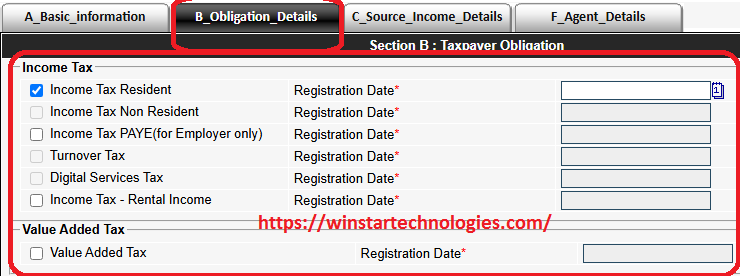

Tax Obligation Details Tab

The tax obligation details are crucial because they determine the type of tax you will pay and the frequency of payment. For individuals, the tax type is typically “Income Tax Resident.” If you are a non-resident, select “Income Tax Non-Resident.” Both types require filing returns annually, with the deadline set for June 30. The amount payable depends on your annual earnings. If you are unemployed, you can file zero or nil returns. After selecting the appropriate income tax type, choose the registration date, which is usually the same day you apply for your PIN.

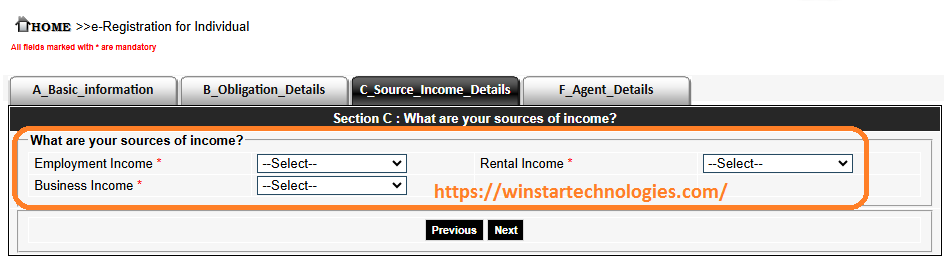

Source of Income Tab

In this tab, you have to indicate where you get your source of income from. If you have no income select no for employment, business and rental income. If you have employment income, select yes and then provide the employer’s pin. Click on the add button to have the employer details saved in the database.

If you earn business income, ensure you have your business registration certificate. Select “Yes,” enter all the required information, and click “Add” to save. Next, choose the sector of the economy your business operates in, and click “Add” to save your selection. If you own rental houses, select “Rental Income,” specify the sector of the economy, and click “Add” to save the records. Finally, click “Next.

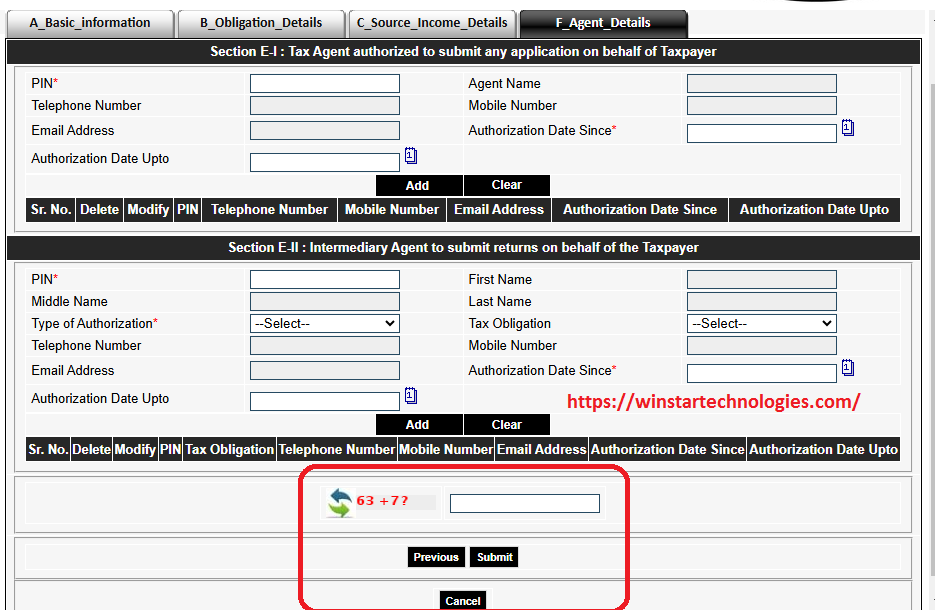

E-Agent Details Tab

This tab is not necessary unless you have an authorized agent who will make the KRA submissions on your behalf. However, if you do, proceed to fill in all the required details. Once completed, perform the arithmetic challenge provided and then click on “Submit.” After that, you will receive a message notifying you that all communications from iTax will be sent to the email address you provided. Finally, click on “Submit” again to finish the process.

Your PIN is generated automatically. Click the provided link to download your KRA PIN. A copy will be sent to your email, along with your password for first-time login.

How to change your First Time KRA Pin Password

Go to your email and locate an email from admin.itax2. The mail will have your KRA pin and auto-generated password. Go to the iTax portal log-in page. Enter your pin and click on continue. Enter the auto-generated password, perform the provided calculation and click on log in.

On the next page, first, enter the old password retrieved from your email. Next, input a new password and confirm it. After that, select a security question, agree to the terms and conditions, and finally submit the form. Remember to note down the password, as you will need it whenever you access the iTax portal.

Check a detailed guide on how to reset KRA PIN password.

Conclusion on How to Apply for KRA Pin

That’s all you need to register for your PIN. If you encounter any issues, feel free to comment below or contact us at 0722808949. We offer Online Cyber Services for a fee.