File nil return using these simple procedures. Filing income tax returns is mandatory for all Kenyans with a KRA PIN. This guide will show you how to file a nil return, penalties for non-compliance, and other essential details.

Why Filing Tax Returns Is Important

When you register for a KRA PIN, you are legally required to file tax returns annually, whether or not you earn income. Failure to comply attracts a penalty of Ksh 2,000, which may be reviewed by the Kenya Revenue Authority (KRA). Non-compliance also prevents you from obtaining a tax compliance certificate, which is crucial for various transactions, such as securing government tenders or loans.

Filing Deadlines

The annual filing period begins on January 1st and ends on June 30th. Avoid waiting until the last month, as the iTax portal may experience heavy traffic, making it difficult to complete the process.

Who Should File Nil Return?

Nil returns apply to individuals with no income during the specified year. If employed, You’ll need to use your P9 form to declare your income. For business owners, tax returns should include annual earnings, expenses, and the applicable tax payable on net profit.

Fil Nil Return Step-by-Step Process

Follow these steps to file nil returns on the iTax portal:

- Log in to iTax

- Visit the iTax Portal.

- Enter your KRA PIN and password. If you’ve forgotten your password, reset it to access your account.

- Navigate to the Returns Menu

- Hover over the “Returns” tab.

- Click on “File Nil Return.”

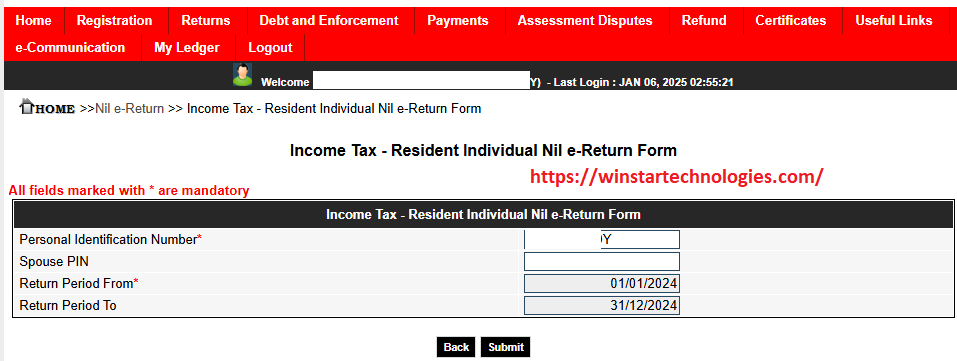

- Select the Tax Obligation

- Choose Income Tax – Individual as the obligation type.

- Enter the Return Period

- Select the return period beginning January 1st of the previous year. The system will auto-fill the necessary details.

- Submit Your Return

- Confirm that you have no transactions to declare.

- Click “OK” to proceed.

- Download the Acknowledgment Receipt

- A link to your nil return acknowledgement will appear. Download and save it for future reference.

Important Notes

- If you have employment income, file your returns using the ITR for employment income option.

- Withholding certificates or advance tax obligations require filing other return types.

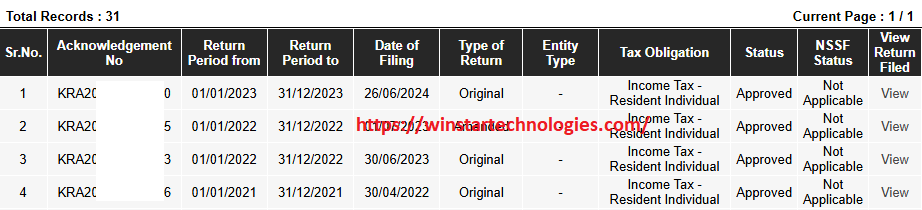

How to View Filed Returns

- Go to the Returns menu and select View Filed Returns.

- This will display all previously filed returns, including dates.

How to Check for Penalties

- Navigate to the Payments tab and select Payment Registration.

- Enter your details, click “Next,” and select:

- Tax Head: Self-assessment tax

- Tax Subhead: Relevant to your obligation

- Pending liabilities, if any, will be displayed.

How to Generate a Payment Slip

- Select the liability to pay, then click Add.

- Choose your payment method (e.g., M-Pesa or bank transfer).

- Click Submit to generate a payment slip.

Conclusion on File Nil Return

Filing nil returns is straightforward and ensures compliance with tax regulations. By filing early, you can avoid penalties and system downtimes. For assistance, you can visit a cyber café or seek professional help, though the iTax platform is user-friendly for those with basic knowledge.

Start your tax compliance journey today!

To file nill return

Hello Ismael, let me know how I can help regarding filing returns.